Wave Review 2020

Plus it’ll do stuff like give you tax reports (for when you’re submitting PST/GST to the gov), sales, outstanding invoices, and so on. Your accountant is also likely to have current copies of quickbooks to read your datafiles (not that I said this, but just give him a copy to read your data files if he doesn’t have one). It’ll should also produce pretty much every type of report your accountant will need.

I wouldn’t worry about Wave’s security–the site may be free, but it uses industry standard security practices. If you compare the “Security” section of Wave’s review with paid accounting programs, you’ll notice it’s quite similar. Can you tell me what procedure you followed to remove the sub-company? I’ve tried to reproduce the problem without success (using the archive function)–but I’d like to look into it further, as the potential for that kind of data loss is (obviously) a serious issue. So far as I know, Wave Accounting is entirely unrelated to Justcloud.

Wave has gaping holes in its usefulness as an accounting program and the fact that you can’t create customer statement or issue a customer credit are just an example of two. People in their forums have been requesting these features for years. There are several threads in their help section that have been running since 2011 or 2012 and are now closed to further comments because people are tired of hearing the “it’s on the roadmap” platitudes. Do your clients a favor and send them in the direction of software that they can grow with.

How do you create a general ledger report in wave accounting which includes the opening and closing balances. When reports are created through the dashboard reports only the transactions for the period are included in the general ledger without the opening balances. You’ll see all income and expenses broken down by account/category there.

I would suggest that really small businesses look elsewhere. Even if you have to buy something it will be cheaper than $725!!!! Don’t believe their marketing about their new “easy” accepting of payments.

The product was designed to help you save the time spent on difficult number crunching, and to automate and streamline the accounting process. Your team relies on you, so you need accounting software that lets you focus your attention on what matters most.

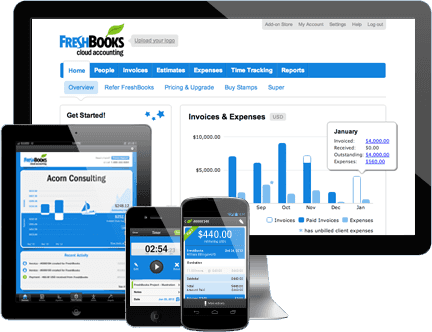

For most small business owners, that’s either monthly or quarterly. My company has used Freshbooks for a long time and do all of our billing via their API. Note that the company also offers discounts for annual payment. You can track time against specific clients and projects in Freshbooks.

So as you can see book keeping stuff is so not my strong suit. I stumbled across MerchantMaverick while looking for a replacement for Quicken. I have decided to try Wave Accounting based on your revue. If you just want invoicing software, no integrations, no accounting, then check out our invoicing software reviews here.

For small and growing businesses, QuickBooks Online can give you a way to manage your business today and grow along with your business tomorrow. With their 50-plus reports available, QuickBooks Online wins the reporting contest hands-down. While FreshBooks reports are useful and provide the information you need, QuickBooks Online offers a much better variety of reports with much better customization options available. There are apps in a variety of categories, including online payment apps such as Stripe and PayPal, as well as Bill Pay for QuickBooks, which allows you to pay bills from within QuickBooks Online. There are also numerous CRM and time-tracking apps you can easily connect to.

However, with Wave, I also received quite a few emails from Justcloud asking me to sign up for their $1 deal for data backup or risk having my data wiped out. I had no idea how this come about and if the data specifically refers to my business data with Wave. Last week, I suddenly found I could no longer issue invoices and receipts with Wave. I wrote to them, it has been 3 working days and no response. Today it worked again and coincidentally, I also received another email from Justcloud asking if they have permission to delete my data.

They were fine with just the accounting end, but I’ve spent hours on this problem and I get little response from them. I actually had to delete out all my invoices, communicate with my clients and resend via PayPal because I was afraid I wouldn’t get my money. My bank says that the information Wave requested to link to my bank account isn’t even what my bank would need to process the incoming payment. I have no idea where my money is…luckily it was only a test transaction. During our time with them we also experienced chargeback fraud.

FreshBooks Review

As of the time of writing, both Xero and QuickBooks Online are rated 4/5 for customer service on Capterra and 3.9/5 on GetApp. Xero is a dream for small and medium-sized businesses in need of a user-friendly approach to their bookkeeping. It’s the most intuitive and easy-to-use accounting system.

Accounts Receivable consists of outstanding invoices, which you’re expecting to be paid. Cash consists of all the money you’ve made this year, to date.

It’s possible that simply accounting won’t let you do that, you’ll have to enter a reversal entry. Accountants are odd that way, they don’t want entries deleted. Originally called Accounting 2.0, the name was unpopular with the company’s staff and the decimal point made registering an internet domain name impossible.

FreshBooks’ Philosophy

You can easily generate a profit and loss report with just a few clicks. You can also create an expense report to track monthly costs and monitor your balance sheet in real time. You can easily filter your accounts records and generate accurate tax reports and tax summaries.

Here it is 2/2/16 and they still have not been done. I call to speak to a manager who could basically care less. He told me they would get them processed after I had to kick and scream. Then they said they couldn’t mail them out and I would have to print them and mail or invite my employees to join WAVE to retrieve it themselves…even after it was WAVE’s fault they weren’t generated. I have also been promised over a year ago that they would be incorporating 1099 contractors this year.

- In my experience, Wave’s customer support has always been prompt and incredibly helpful.

- I have been using Wave for the last few weeks and have really liked the software as it is easy to use and does what is says.

- Its main features include project accounting, time tracking, task management, subscription management, fund accounting, revenue recognition, point-of-sale, and recurring invoices.

- And depending on your situation, Zoho Books might be the best fit.

- Even though they pull transactions from my bank account, that doesn’t mean they are able to push payments to the same account.

- However, such backup data is usually not available on-demand to customers.

Until then, the software is still a good solution for small business owners looking for a simple, easy to use accounting software that won’t break the bank. Wave’s customer support resources and new Wave Advisor services make it easy for people with limited accounting experience to learn the software. It’s also great for Etsy shop owners and other eCommerce businesses using Wix, Squarespace, or WordPress. Wave provides completely free accounting that allows small businesses to track expenses, send invoices, get paid and balance their books.

Xero also has instructions for easily converting from QuickBooks to Xero. However, Accounts & Legal Consultants shared how Xero successfully managed the accounting for one of their large clients with 50 stores in the UK. Xero told them that the soft limits for transaction volume are around 2000 sales, 2000 purchases and 4000 bank lines per month, after which Xero’s performance “deteriorates dramatically”.

Was led to believe I could generate invoices in the field printing hard copies for my clients to sign upon completion of work but that is not possible with this software! Do not waste your time with Wave if this is what your looking for! Invoices printed Freshbooks in my office are just fine but to print in the field you have to export them as a PDF to yourself then print that! Unfortunately the invoice you end up with is very cartoonish and not something I would ever allow a client to sign (or much less see).

With QuickBooks, it’s incredibly easy to connect your bank account – the feature at the foundation of your bookkeeping. There is a tiny amount more friction from Xero, and https://accounting-services.net/freshbooks-review/ the bank feed connection is slightly less seamless than with QBO. Both Xero and QuickBooks Online offer inventory management functionality, but QBO has the edge here.

Businesses can send professional-looking invoices in any currency, track bills and find out who owes them money in an instant with the easy-to-use Brightbook system. That’s a tough one, because which program I’d recommend depends a lot on the company. Wave will be great for some; QBO for others, Xero or Zoho Books for still others. The tricky thing with accounting software is that there’s no “one size fits all” solution that is best for all companies–even all small companies.

The project tracking you refer to is called “job costing.” Not all accounting software offers it, but several programs do, including Xero, FreeAgent, QuickBooks Pro, QuickBooks Online (Plus), and Saasu. Splitting bills is no problem; I believe any of those programs will allow you to do it (simply break down the service on the bill into multiple lines and assign them to different projects). All but QB Pro have free trials (and QB Pro usually has a money-back guarantee for the first 60 days), so you can check them out before buying. I’ve been using it for about 5 months to record transactions, but have not linked my bank account. It sounds like most the complaints are with payment transactions and linked bank accounts.

I have some of my clients from micro-business or freelancers so I am suggesting them to use Wave because it almost satisfy all their requirements except one or two but we can manage them on our own. I need your review of data retrieval from backup/ archive in case i dump wave, xero etc for another more capable program.

Our verdict: Comparing Xero vs. QuickBooks Online in 2019

Steer far, far away go with Ceridian or any other large payroll company who is actually there for their clients. Wave has a good platform but their customer support is useless and will cost you thousands of dollars in issues if there is a problem with tax or T4 entry. Looks good on the surface but it’s https://accounting-services.net/ glitchy and unreliable. The people (if you can manage to actually talk to anyone) are nice enough, but they’re totally useless besides telling you to clear your cache and cookies. I could go on and on but simply put, this ‘free’ software can end up costing you a lot in time and potential business.

You can definitely enter cash payments from your customers. “Cash basis” and “accrual” are different accounting methods; you can find a great description of the difference in Chelsea’s guide to accounting terms. Wave does offer 3 invoice templates and provides a space for your company logo.

Liza uses a template and schedules the email and late payment alerts. Now, all she needs to do is check her PayPal account in the weekend to see how much payment she has received. It definitely hits a pain point of a lot of startups and small businesses when they are trying to figure out the best accounting software for their company. After choosing QuickBooks, having a walk through the intricacies was important and extremely helpful. Its key features include automatic bank feeds, invoicing, accounts payable, expense claims, fixed asset depreciation, purchase orders, bank reconciliations, and standard business and management reporting.

Some Drawbacks of FreshBooks

If you want more functions than any of these options offer, then you’re probably looking at locally installed software, most likely either QuickBooks or Sage 50 (formerly Peachtree). I don’t mind plugging in the numbers and pulling up charts and stuff. I want to create things and sell things and enjoy my business. I have 0 employees and I’m trying to start a business. I tried using excel but, I feel like I need to be an accountant to do that.

This should resolve any connection issues you may have been experiencing with our old bank data provider. ” There had been not connection issues with the previous. But since the change, my rolling LOC, a critical part of my business can no longer connect. All my other transactions were then being imported in duplicate.

Under this arrangement, many subscribers pay up front, and receive the product over time. This creates a situation in which the amount is recorded as unearned revenue or, as Morningstar calls it,deferred revenue.

If they charged the same as quickbooks I would not use Wave. But it is free so the price is right and I think quickbooks is over priced. I have been a user for 3 years and they keep making changes and not all for the better.

Wave

Now that FreshBooks has an amazing new version rich with improved features, the list of benefits became considerably long. Below we analyze the most important among them and explain how they can benefit your company. FreshBooks is a reliable and fast accounting suite that turns otherwise complex financial management into an enjoyable experience. No clear winner in this one, since both FreshBooks and QuickBooks Online offer easy connection from within their respective application to connect with numerous apps in a variety of categories. QuickBooks Online offers easy access to app from their Apps option.

Visit Today :

Visit Today :  Total Visit :

Total Visit :  Total Hits :

Total Hits :  Who's Online :

Who's Online :